CEO’s taking public positions on hot button issues is nothing new.

Ben Cohen and Jerry Greenfield made it a part of their namesake ice cream company’s mission to support social causes. Apple CEO Tim Cook has long made public his support of gay marriage and advocacy for the children of undocumented immigrants who were born in the U.S.

For the most part, though, few people cared what a CEO thought about this or that issue, or what kinds of policies their companies had.

But as the country has become more polarized, CEOs have found themselves pressured to take stands on social and public policy issues, many of them controversial hot buttons. Consumers are increasingly asking leaders to turn their companies in support of the environment, immigration, COVID-19, LGBTQ+ rights, and race, among others.

Michael Durney, assistant professor of accounting, wondered how this CEO activism affected investor reactions. How do investors factor a CEO’s activism into their decision to buy or sell a stock? What about (in)activism?

In a new study, Durney and his research team conducted two lab experiments to determine how investors respond to activist CEOs. They gathered 946 online stock traders and told them they own stock in a fictitious telecommunications company. After reviewing financial and operational information about the company, some of the investors were told the CEO (whom they blandly named Roger Smith) has taken public positions on either gun control or abortion. Meanwhile, other investors were told CEO Smith has taken no position on controversial issues.

Investors were then asked if they would like to sell their shares in the company or buy more.

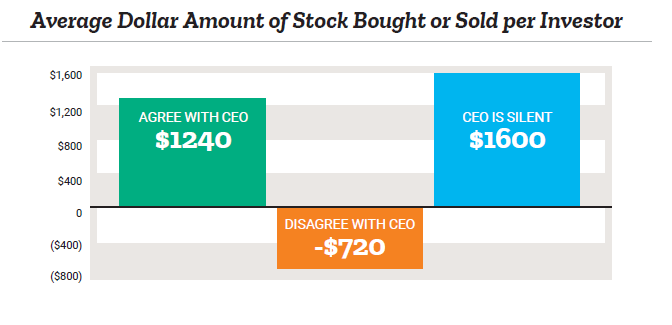

The study found that the CEO’s position significantly affected investing decisions even when he was weighing in on an issue unrelated to firm fundamentals. Investors who agreed with the CEO bought stock and investors who disagreed with the CEO sold stock, a result he said is not surprising in a polarized world.

But what surprised Durney is that when the CEO took no position, investors reacted as positively as they did when they agreed with him. The silence prompted investors to project their own views onto the CEO, so they believed he shared their values.

And what happens when a CEO takes a position based on a prompt from a third party, such as a financial analyst demanding “Smith” give his position? The results show it makes no difference.

Durney said the findings show the danger in CEO activism because speaking out will inherently offend a significant number of potential investors. Inactivism, on the other hand, not only offends very few people, it also seems to give investors permission to think the CEO is on their side.

This article appeared in the 2024 issue of Iowa Ledger.