We all know public accounting is a demanding industry, especially during overlapping tax and audit seasons. But many top accounting firms have a secret weapon to fight employee burnout: the well-being subsidy.

Deloitte’s well-being subsidy program is long-running and packed with reimbursement options—everything from kitchen appliances and spa services to special pillows and Nintendo Switches. Really, anything that employees could use as a stress-reliever.

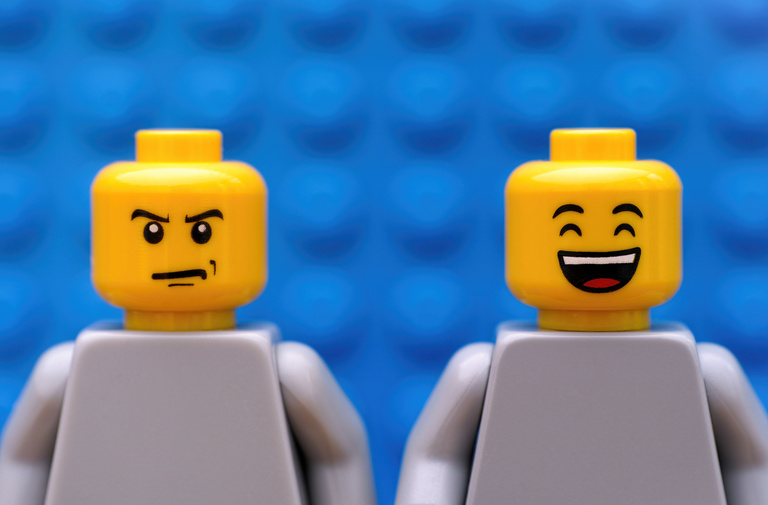

This summer, the firm made headlines after announcing an expanded list of approved items. One interesting addition? Legos.

Casey Daniel (MAc25), a new audit and assurance assistant at Deloitte, even heard about someone who used the subsidy for a smoker to support their hobby of smoking and grilling meats. Daniel sees himself using the money on new AirPods to try while exercising or maybe some golf lessons.

There’s real power in employers supporting resilience and stress relief, especially in an industry as intensive as public accounting. Even seemingly small things like building a Lego set or having a portable cooling fan at your desk can go a long way towards job satisfaction.

Subsidies also seem to be working as a recruitment tool according to some Tippie alums.

“There are a lot of negative stories of work-life balance in public accounting,” Daniel said. “Hearing about things like generous parental leave and well-being subsidies as a college kid makes you think, ‘Okay, maybe it's not so bad.’”

According to our research, many firms are now offering well-being benefits:

- DELOITTE offers a well-being stipend of up to $1,000 for qualifying expenses ranging from gym memberships and ergonomic office furniture

to musical instruments, composting equipment, and Lego sets. - EY has a program called the “Extraordinary You” fund which offers up to $3,000 annually for qualifying expenses that “promote health and happiness.” Examples include vacation lodging and travel, gaming consoles, massages, and mattresses. EY also offers $500 for commuting and pet care expenses.

- KMPG—Client-facing associates and senior associates have access to a well-being reimbursement for expenses such as spa services, gym memberships, ecofriendly products, family care, and more. In addition, KPMG offers a “care giving concierge” program to help employees navigate challenges as well as fertility coverage and an adoption/surrogacy reimbursement.

- PwC—According to Jiyun Chong (BBA19/MAc20), a tax manager at PwC, the firm offers a discounted “Gympass” membership, giving employees access to several gyms or fitness classes without being tied to one. They also provide free memberships to the Peloton and SWEAT apps, along with small monetary incentives for hitting fitness goals.

- RSM has “Beneplace,” a program that offers discounts on a variety of products, including recreation, travel, and personal services. RSM offers supportive services for employees and their families, including backup childcare, adult care, eldercare, college coaching, and discounted tutoring. Employees also have access to complimentary backup pet care and exclusive discounts on pet insurance.

This article appeared in the 2025 issue of Iowa Ledger.